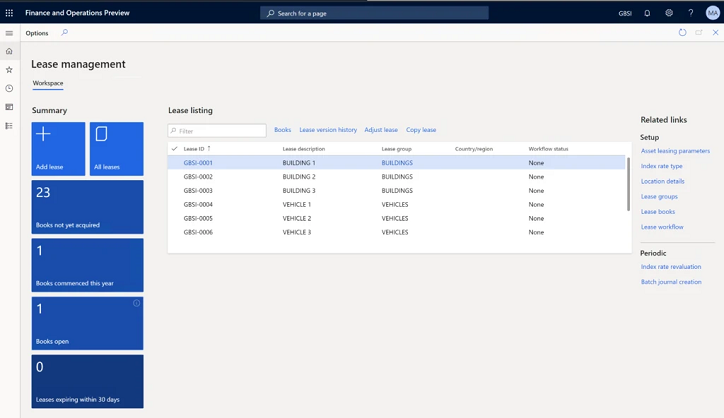

Microsoft is now adding the lease accounting capabilities to Dynamics 365 Finance by November 2020.

Today we are introducing the lease Accounting Optimiser features, for businesses based in Australia

You’ll be able to manage the lease accounting processes. And also manage all of it during the promotion of compliance with lease accounting standards.

So, if you are looking for more details. Let’s dig deeper into it and learn about the features to understand the importance.

Regardless of how strong companies get and find solutions or plan them properly, they can always ask to expect changes. So, one of the major changes that you might be looking forward to being associated with leasing asset management.

Now, the first question is: why do companies go for leasing of assets?

As an overall help, it reduces the financial risk. And with the automation, you can adapt easily and be compliant to the FASB and IFRS 16(read details) accounting regulations related to leasing management and its financial impact. Moreover, there will be no more manual errors to be taken in an account.

Let’s just find out more and learn about the features in detail…

Features of Dynamics 365 Finance asset leasing

Following are the functions you can use to manage your leased assets:

- Automation of the lease calculation considering the present value of lease along with the future lease payments. Automise the liability of lease and also automates the right-of-use asset depreciation and expenses schedules.

- Also, it helps you to classify the lease as short term or low-value lease or as operating or finance. The process of classification includes the transfer of ownership, purchase option, lease term, present value, and unique asset.

- The function also centralizes the management of lease information. It means that any important dates from commencements to the expiration along with the currency, amount, and payment frequency can be known through a single platform.

- It also helps in generating the accounting entries for recognition in the beginning and subsequent measures of liability of lease with the right-of-use asset.

- Also, you don’t need to waste more time on complex calculations of lease modification, it will make automatic adjustment transaction without trouble.

- The functionality makes reporting easy by providing posting to different layers to accommodate. For example, you can get tax reports in Dynamics 365 Finance.

- It uses the balance sheet impact calculator to represent leases in balance sheets and also complies with the accounting standards.

- You can have the audit controls over the integrity of data on lease to make sure that the posted transactions do not differ from calculated amounts of current value, future payments, and liability amortisation.

- You will also have the tools to easily import or export to excel for the lease data.

- It has the features to help you prepare asset leasing reports, including the disclosures and notes.

- It can easily integrate with the chart of accounts, currencies, fixed assets, vendors, journals, data management, and number sequences of your company.

Final Thoughts

If you are already familiar with Dynamics 365 FO (read about the changes 2020) you would also know a lot about asset lease Australia. Now, that this function is a part of the software, lease management can be more easy and smooth. So, for the integration of any kind of assistance regarding asset leasing, DHRP can help you with a complete process.