According to Gartner, 85 percent of finance teams are undertaking or planning a financial transformation, and the enterprise resource planning (ERP) market is estimated to approach $4.95 billion by 2025. A successful financial transformation would be practically impossible without ERP software; yet, picking which system to invest in is easier said than done. It’s critical to select the correct ERP to meet your business needs and provide you with all of the capabilities required by your sector.

A quick Google search yields a flood of ERP checklists and templates that aren’t sufficiently personalized to be useful. If you want a list of every feature an ERP might have, this is the place to look. However, rather than being overwhelmed by extensive lists of expensive features you’ll never use, it’s best to start with your company’s specific demands. Making a custom checklist of your specific requirements will assist you to avoid wasting money on features that aren’t related to your company’s goals. The stages below will walk you through creating an ERP requirements checklist, which is the first and most crucial step in your financial transformation.

Make a Research and development of the list of requirements

Your employees will be the most familiar with the reasons why you need a financial transformation because they work with your current system every day. Because they have firsthand experience with the features you’ll need as your firm expands, their advice is invaluable. Make a list of criteria with your team, then go over it again to rank the features as “must-haves,” “good to have,” and “nice to have.” You’ll avoid decision paralysis if you keep your team’s goals front and center on your final list.

Consider company reputation and integration

Create a shortlist of ERPs that meet your needs once you’ve decided what you’re searching for. There may be more than you think, thus further categorizing each of these ERPs is essential. It’s best to think about each company’s reputation as well as the integration capabilities of each system. Working with a company that doesn’t have a clear implementation plan or support team in place could sabotage your change. Even the most sophisticated ERP software will be rendered useless if it is not properly integrated. It’s also crucial to see if the system will function for your business; for example, an ERP created specifically for retail supply chain management will be of little use to a healthcare provider.

Set a realistic budget covering the total cost of ownership and ROI

The next step is to calculate your return on investment (ROI), which will be more difficult. Examining the costs and benefits over time helps to gain a clearer perspective, allowing you to precisely determine the amount of money saved by system changes. On average, businesses may expect to recoup their investment in sixteen months and obtain a 200 percent or higher return on investment.

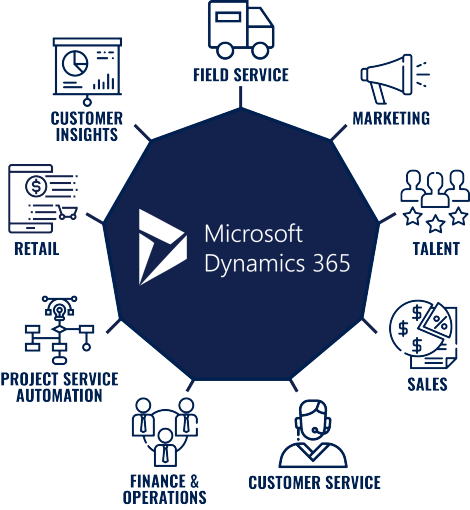

While the average ERP returns $7.23 for every dollar invested, some ERPs outperform others, such as Microsoft Dynamics 365, which returns $16.97 for every dollar spent.

Get buy-in from upper management

Choosing an ERP is a huge financial commitment. Your new system will be at the center of your company for at least a decade, and it will completely change the position of your finance department. It’s vital that higher management comprehends the project’s full worth and the impact of business complexity on costs. Expecting to lower costs and improve service at the same time, or associating customer service with the value given, are both common blunders in financial transitions that fail. To ensure that your finance department develops into a more valued business partner, set realistic expectations with senior management and your staff from the start.

Centralized database

To improve the role of your finance department, you’ll need a single database that integrates data from many departments and meets operational needs. When finance wants to interact with other departments, decentralized systems result in segregated data, which creates bottlenecks. A centralized source of data can cut the time it takes to conduct processes like account processing in half.

Predictive analytics

Slow and irregular payments stifle cash flow and make long-term planning difficult. You may keep better informed with rolling estimates based on customer payment histories and finance trends by leveraging the power of AI. Financial managers can use predictive analytics to recognize credit risks and distribute funds correctly to streamline payment processing and collect revenue faster.

Real-time reporting

In a 2017 poll, 78 percent of respondents agreed that during the last three years, decision-making has grown more data-driven. Real-time data access is possible with ERPs. Your team can maximize production planning and project management by having the most up-to-date information available at all times. Your company’s overall agility will improve as it becomes easier to overcome market disruptions by making swift pivots based on real-time information. This function is especially useful in the manufacturing business, as teams review procedures and coordinate projects by conveying product-related information across numerous locations at each step of development. Dynamics 365 finance and operations financial reporting is one way to get at this level.

Compliance management

This function is critical if you work in a highly regulated industry, such as healthcare or financial services because it guarantees that your company remains compliant. Compliance regulations are always changing, making it tough to keep track of them as a business grows. If you want to expand your service offerings or enter new markets, you’ll have to follow new rules. Because noncompliance with regulatory standards can result in millions of dollars in fines and penalties each year, having a comprehensive compliance management system can help you avoid fines and penalties.

Scalable security

As your organization grows, you’ll certainly acquire and handle more data; but, if you’re sending reports and sensitive information between numerous platforms, the chance of compromising that data will expand as well. The average cost of a data breach in 2021 was $4.24 million, and using analog systems doesn’t ensure data security, as Elkhart Emergency Physicians discovered when they mistakenly exposed 550,000 records because a third party didn’t shred the documents before discarding them. To greatly reduce the danger of a security breach, it’s essential to avoid data vulnerability by investing in ERP software with a solid, scalable security system.

Supply chain management

Warehouse and inventory management may be greatly improved by automating data entry, materials sourcing, and inventory of goods. You can also establish a trackable history with software to acquire insights into the performance of various items and troubleshoot supply chain concerns. Look for software like Microsoft finance and operations that will go above and above, allowing you to compare prices from all accessible vendors to ensure you’re always getting the greatest bargain. Companies that deal with complex supply chains on a regular basis, such as those in the retail and distribution industries, should emphasize this aspect because better management leads to higher customer satisfaction and retention.

Subscription billing management

Recurring billing methods, which were once only used by SaaS companies, are now being used by businesses across many industries. If your business provides or plans to provide subscription-based services or recurring payments, you’ll need a subscription billing management ERP. Your system will have to deal with deferred revenue, keep a detailed record of revenue recognition, and adhere to rules like ASC 606.

Get in Touch

So, are you ready to transform financially? Qualified ERP can do the magic for financial services and supply chain Accenture.

Here, the team of DHRP is ready to take your business or your organization to another level by offering custom dynamics 365 finance and operations features. With the improvement in supply chain management and its finances, you can also help your employees to perform with efficiency. Ultimately, save your money and time in the supply chain department by investing carefully in an ERP system. Let us help you with the customized system for your firm, call now!