A finance leader’s conventional role is to concentrate on financials’ end-state aspects. On the other hand, finance leaders must understand and use data to forecast, affect, and eventually form financial results in today’s data-rich world.

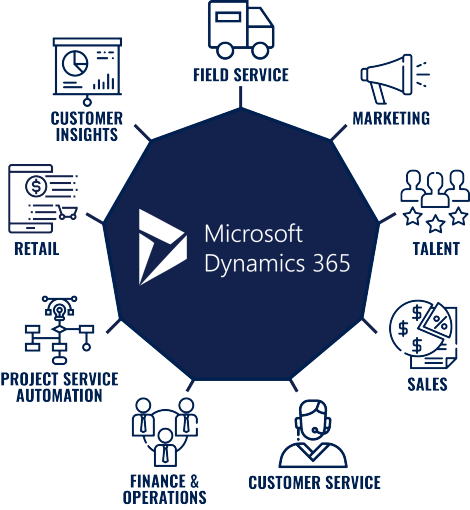

So, how do today’s finance leaders transform data into useful information? Here are 7 ways you can use Microsoft Dynamics 365 Finance to practice data alchemy.

1. Look for data everywhere

Data is all around us. Finance executives must shift their focus away from the general ledger and review all data outside of the chart of accounts. Leaders must also determine which data sources are critical to the company’s success.

A project-based company’s data requirements, for example, would necessitate more in-depth insights into any project, past and present. In contrast, a software company would be more interested in data that aids in analyzing new versus recurring revenues. Most importantly, leaders must distinguish correlation and causation by comparing different sources of micro and macro-level data.

2. Identify Opportunities

Non-financial indicators that encompass drivers of business success are usually 15 to 20 in number. Finance leaders must figure out what they are and how to ensure the data is processed, exchanged, and used regularly. If you’re unsure or just getting started with results, use this as a jumping-off point and go from there!

A client who supplies OEM auto parts to major vehicle manufacturers is an example. They discovered that “on-time, in-full delivery” was one of the most important drivers of performance after analyzing results. The enterprise’s attention shifted dramatically after data on that single metric was obtained and posted regularly to the enterprise dashboard.

3. Clean your data

Unfortunately, businesses must deal with “dirty data” until systems obtain data without human interference. “Garbage in, garbage out” is a phrase we’ve all learned and practised. If the data was not consistently collected, incomplete, or not preserved, it would almost certainly need to be refined before it can be used.

CFOs must develop a systematic approach to ensure that data is clean and consistent across systems. Otherwise, insights would be gained from inaccurate and deceptive data – the data world’s fool’s gold.

4. Unite your Islands of Data

Just a small number of companies have all of their data in one place. Internal data is frequently duplicated through many business processes, and external data is frequently distributed in bits and pieces. Because of the “disconnected” data, we must deal with “islands of data”. These data islands aren’t like Legos in that they don’t easily fit together. They must be converted and manipulated before they can be used.

The good news is that applications like Microsoft Power BI, which can pull data from various systems for reporting and analysis, are now accessible at a low cost. Furthermore, Dynamics 365 now allows you to build an automatic data warehouse/data lake where data from Dynamics and other systems can be centralized before being loaded into Power BI. Identifying data islands and implementing data centralization for proper use is the responsibility of finance leaders.

5. Scale your Data operations

Data on its own is unreadable. To shine with insights, it must be polished, packed, and viewable from all angles. Most businesses serve data in Excel, which requires a significant amount of administrative time. Excel will be excellent if you have an Excel guru who updates spreadsheets daily and remains with your company forever. However, Excel is not a scalable or sustainable data delivery method.

The leadership team’s responsibility is to invest in data visualization or business intelligence software that allows for the intuitive display of historical data. It lends sophisticated analysis that will help guide future action, either through real-time predictive analytics or ML/AI tools like Microsoft Synapse.

6. Drive Accountability for Data Usage

If data is safe, centralized, accessible, and served to decision-makers, it is up to those decision-makers to use it. This is where I return to one of my favorite adages: “Trust, but check.” Like any other investment, finance leaders must track key decision-maker use of this “data-to-insights” investment. I normally advise businesses to begin using their enterprise dashboards (data) as a wall of fame and shame for leaders, as well as to practice full accountability by kicking off weekly, quarterly, and annual performance meetings with the dashboards displayed front and center for all.

Decision-makers could then use the dashboards to elaborate on observations and decisions that helped shift the needle. The only way to transform data into outcomes is for leaders and decision-makers to make the most of it.

7. Ensure your data Security

Data, as a precious resource, must be safeguarded and governed. There are several advantages of being a data-driven company, but there are also dangers to consider:

Data validity and ethics – ensure that only reliable data is used and that fair conclusions are drawn. Assume unethical activity is used when reporting on data (for example, fake data is created or impractical inferences are drawn). In any situation, the company faces serious reputational damage as well as possible legal and financial penalties. CFOs must outline stringent and supervised data collection, storage, and analysis procedures and ensure that everyone involved is kept responsible for the highest ethical standards.

Data Security: Prioritize data confidentiality and privacy when it comes to data security. Data, like any other valuable resource, is vulnerable to theft. When an entity begins to acquire and mine data, there is a possibility that the data may be hacked or exploited by foreign organizations seeking to manipulate it. Data security necessitates substantial investments in data protection technologies and governance. If not done correctly, it can have long-term and negative consequences for the company.

Bottom Line

The finance team should collaborate with other leaders to incorporate data protection policies and practices into the enterprise’s fabric, including job agreements, IT SLAs, and privacy policies. Many countries still have strict rules on how and when data should be used. It is critical to implement and continuously track data protection enforcement and data access regulations. This is where Dynamics 365 and Power BI play an important role in helping you plan your financial strategy. To implement Microsoft Dynamics 365, let the DHRP team be at your assistance.